Is it true that you are steady with keeping up exact financial records for your business? Numerous entrepreneurs are so up to speed in the difficulties of staying with the running that they disregard the fundamental strides of financial administration and following. It is not difficult to get occupied by worker the board, income concerns, and item advancement. In the event that your consideration is gone to other business needs, your financial records may tumble to the sideline.

Truly we can’t put sufficient accentuation on the significance of business financial records. These numbers show the tale of your business achievement and flimsy spots. Having the privilege financial data accessible will execute the methodologies that are significant for your firm, just as the choices that are made going ahead. Your financial records can in a real sense show whether your firm will be expanding or diminishing in esteem.

Here are a couple of ways that your financial following and detailing can impact the estimation of your firm:

Straightforwardness for Better Decisions

At the point when you are making choices about how cash will be reinvested in the firm, it very well may be a test to settle on the right choice on the off chance that you don’t have precise data. It is fundamental that you keep up straightforwardness in your financials so your choices will line up with the truth of what’s going on in your firm.

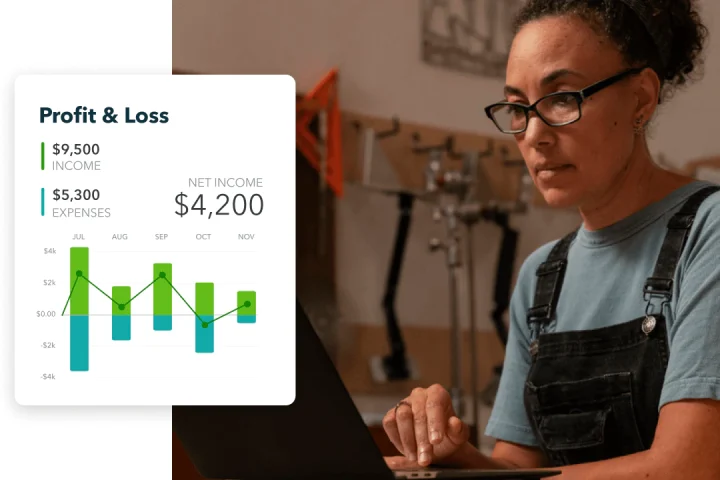

You can see reports to see the income that was procured throughout some undefined time frame. Remember that this data is just a piece of the riddle. You ought to likewise assess the real money available, just as costs or expected costs that will influence your income.

Assuming anything is accounted for mistakenly, it can have a cascading type of influence on the achievement of your firm. Simultaneously, these issues are not difficult to maintain a strategic distance from on the off chance that you execute the correct framework for following and evaluating. A decent online bookkeeping services can assist you with understanding the presentation of your business so you can execute the systems that will change your direction for what’s to come.

What amount would you say you are Paying in Taxes?

Duty liabilities are straightforwardly attached to the precision in your financial circumstances. As an firm or entrepreneur, your duty liabilities can be high, which adversely affects your income and benefit. What amount of cash will you have left in the wake of paying the public authority? Precise financial records will give you a reasonable picture so you know the supports that will be accessible for future business costs.

Methodologies can be utilized to decrease your taxation rate. An accomplished bookkeeper will actually want to offer exhortation in regards to the benefits and allowances that fall inside the satisfactory lines for the IRS. In addition to the fact that you need to make a reasonable, exact picture for the IRS. However, you likewise should be reliable about your financial following so you can back up the numbers if there are at any point inquiries concerning the exchanges that are traveling through your firm.

Diminishing your taxation rate boils down to the manner in which you are dealing with your costs and asserting these discounts. Indeed, even the littlest subtleties may appear to be minor, yet they can accumulate over the long haul. Ensure you are recording each dollar that is spent on operational expense so this data can be utilized while figuring your taxation rate for the year.

Great Financial Records Reduce Errors

How frequently have financial blunders fallen through your business, making you lose cash? Assuming you don’t have a decent framework set up, it is difficult to figure out where you have missed out on cash that ought to have been gathered. Your financial frameworks ought to be planned with governing rules set up so you can distinguish any possible exchanges or solicitations that were neglected.

For instance, many bookkeeping administrations offer month to month compromises. Not exclusively does the bookkeeping group stay aware of the every day and week after week exchanges, however an inward examining framework is utilized every month to ensure the entirety of the records line up.

On the off chance that an inconsistency is distinguished in the administrations that were delivered and the cash that was gathered, at that point it is a decent sign that you need to direct your concentration toward assortments on the exceptional solicitations. Getting more cash will guarantee you are ensuring the general estimation of your firm by securing your net revenues.

Besides, the privilege financial framework is fundamental to recognize any possible dangers for misrepresentation. Despite the fact that you need to confide in your workers and the board, there will never be an assurance that criminal behavior will not occur in your office. Keeping precise, nitty gritty financial records will help you get botches in the beginning phases before they transform into something that cuts down your firm. It is fundamental that you have the correct framework set up to distinguish interior bad behaviors so you can dodge significant issues later on.

Advance Payment Trends for AP/AR

Focus on the income patterns to check whether you discover a pattern of income gives that spring up consistently. In the event that you find there is a pattern or subject in the occasions that you are confronting difficulties with dealing with your income, at that point it very well may be an ideal opportunity to make a few changes with your Accounts Receivable and Accounts Payable frameworks.

Yet, you need to return a stage to guarantee that you have precision in your fiscal summaries. Off base solicitations can make it hard to comprehend the unmistakable picture with respect to cash that is streaming all through your business. You should be certain you have right data about the expected cash that will be streaming into your firm. Simultaneously, these financial records can assist you with being ready for costs that are coming up: compensation, profits, charges, business advancement, lease, utilities, credit installments, and the sky is the limit from there.

Read Also – 5 Trends that will define the future of accounting in 2021

Inadequately kept financial records will make it practically difficult to stay aware of these commitments since you don’t have the foggiest idea when the installments are expected. Subsequently, you may confront late expenses and premium charges, which can have a cascading type of influence to make it considerably harder to stay aware of your income. Running appropriate counts and carrying out a decent income framework is fundamental for assist you with staying away from the credit gives that could be the ruin of your business later on.

Financial Information Ensures Quality Decisions

All that really matters is one basic idea: you should be certain you are settling on the correct choices to help the requirements of your firm. These choices can impact the opportunities for your firm later on. At the point when an entrepreneur is continually settling on choices responsively, it implies they are figuring sufficient cash out to cover the prompt bills. It is a battle to plan ahead and plan for conceivable outcomes on the off chance that you can’t stay aware of the current prerequisites.

Then again, the correct technique for your financial records can assist you with assessing the truth of the numbers for your firm. You can discover the zones where the business needs somewhat more consideration. This interaction is an extraordinary method to fill in the holes where you are losing cash or passing up benefit potential.

Try not to think little of how much your financials will influence any remaining parts of your firm. At the point when the accounts are disorderly, at that point it makes a colossal wreck that can be difficult to pivot later on. Rather than trusting that the issues will surface, you should be proactive with executing the correct situation right presently to be certain you are ready for what’s to come.

Picking the Right Services to Improve Your Finances

Since you can see the significance of improving your financial records so you can ensure the estimation of your firm, you may be pondering where you need to begin to make something happen. On the off chance that you don’t have bookkeeping or accounting experience, it implies you need to look to somebody who comprehends this part of your business.

You have the alternative to recruit a representative, however you should bear the weight of their compensation and overhead expenses. All things considered, the keen arrangement is to discover a rethought bookkeeping administration that can help you assemble the correct establishment. Our group is here to help with the execution of good accounting services in miami, giving you a solid financial base that will uphold the future development of your firm.

Not exclusively would we be able to help with the way toward setting up the correct framework for your firm, however we are likewise here to offer the progressing support that you need. These administrations envelop everything from charge system to finance the executives. At the point when you let our group deal with the financial following and procedure, at that point you can direct your concentration toward different duties that will assist with the development of your firm.